First of all what is the free market?

free mar·ket

noun

noun: free market; plural noun: free markets; modifier noun: free-market

an economic system in which prices are determined by unrestricted competition between privately owned businesses.

So what does that mean? Well it means that people are able to trade services and good to consumers. The companies providing the services or goods are able to compete with each other for the consumers and can do so by lowering prices. A free market is essential for all of us because we want to have things at the lowest cost. Companies need to compete with each other for us and they do so by lowering cost but by doing so they have to find a way to lower production cost for them as well. If the companies are able to compete for us, why does there have to be government intervention? Do we need to have the government get involved with the free market? Well the answer to this is very difficult to answer.

First of all we have to take in count why the government would want to step in? The main reason was to have some law and order set in place. Without law and order we would have criminals being able to get away with everything and then eventually companies would go out of business. Companies need law and order to keep going, without it we would have a lot of crimes, such as theft, and no one would be able to stop it. Well also need government to protect companies from bankruptcy. If for some reason a company fails we have rules to set them up to be able to be successful again.

Why would we not want the government? Well there is all the benefit to the companies to not want to let the government intervene. The companies then do not have to pay taxes and then get to pocket all of the profits. They are not responsible to contribute to the state like a citizen would because they are the ones who are making the economy right? Well wrong because we are all responsible to keep this country great like it is now. Some how this idea of not paying taxes seems great for the companies but why would it cause us harm? In the long term would it be a harm for the companies to not contribute?

Well not paying taxes would harm everyone including the companies, maybe not right away but in the long run. Taxes are needed for the country to keep running smoothly because we need that money to put back into the country. We use the tax money for the people and for the welfare of our country. The money also goes towards our defense. We use a lot of the money to go into the military to keep our country safe and other countries as well. Taxes go to a lot of places for the great good of America. We as citizens pay 47% of the taxes while corporate taxes only make up about 11% of the taxes. As citizens we pay a lot but the companies are the ones who have more wealth and should be contributing more to the economy. If they have an abundance of money they can give to help out the people in need and the country they so much love.

So if taxes were to be cut down from the companies, would companies have more money to invest and eventually the lower classes would get that money they are saving? Yes they might have more money, but what would be their incentive to invest. They wouldn’t, they would save that money or distribute the money within them. If we have taxes, companies have incentives to spend money thinking that maybe they would end up with a bigger profit from the returns of the investments they chose to start.

Companies only work thanks to the middle class who chooses to give their money up for something.The money the middle class earns has all the power of making the company a better company, but how would that happen if the middle class did not have any money to spend? It just wouldn’t because we would not have money for things we needed. If the people choose to make an effort to contribute to the economy so should the companies and pay taxes in order for the cycle to keep going.

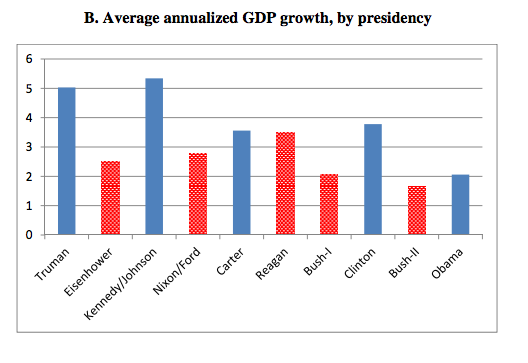

When our president Warren Harding dropped the taxes from 75 to 21 percent the economy eventually crashed and we went to the great depression. After Warren Harding FDR raised the tax on the upper class to 91 percent the economy became better again. The whole country recovered and we had it better again. Later Ronald Reagan came into office and lowered the taxes again, which cause the worst recession since the great depression, well then Clinton came in and again the country regained its wealth. So why do we not see that raising taxes helps the economy grow? When will the data ever be enough to prove that taxes are needed to help the economy grow?

![1960-kennedy-nixon-debate[1] 1960-kennedy-nixon-debate[1]](https://election2016cudenver.files.wordpress.com/2012/09/1960-kennedy-nixon-debate1.jpg?w=262&resize=262%2C197#038;h=197)

Tony Robinson

October 4, 2016

I appreciate this thoughtful post on some very important economic issues that are stake in this election. Though the candidates don’t focus on these kinds of vital policy debates enough, voters need to be better aware of the competing economic/taxation policies that animate the two parties–so analysis like this is much needed.

Your analysis of why taxes are needed and how they support a healthy society and balanced economy is important, and you have some good evidence in your source links to support those claims. The cartoon is clever and revealing of the heart of the demand-side thinking.

Speaking of demand-side versus supply-side thinking, it would have been good to better frame your analysis in terms of reference to these fundamentally different camps of economic analysis. I lectured on these themes (and I see that you linked to one of the lecture slides!), and you could have usefully explained how the GOP perspective fits into what is called a “supply-side” approach, while the Dem perspective argues for the need of government intervention on the “demand-side.” That would have added a bit of integrating organization to the paper.